When it comes to growing your wealth, finding the best savings rates is key. Whether you’re saving for a rainy day, a big purchase, or your retirement, maximizing the interest earned on your savings can make a significant impact on your financial well-being. Here’s everything you need to know about finding the best savings rates and making the most of your money.

What are Savings Rates?

Savings rates refer to the annual percentage yield (APY) that banks and financial institutions offer on savings accounts. This rate determines how much interest your savings will earn over time. The higher the savings rate, the more money you’ll earn on your savings.

How to Find the Best Savings Rates

- Compare rates online: Use websites and tools to compare savings rates from different banks and credit unions.

- Check local banks and credit unions: Sometimes, local institutions offer competitive rates that may not be advertised online.

- Consider online banks: Online banks often have higher savings rates due to lower overhead costs.

- Look for promotional rates: Some banks offer promotional rates for new customers or for opening certain types of accounts.

Read more about best savings rates here.

FAQs about Savings Rates

What factors affect savings rates?

Several factors can affect savings rates, including the overall economy, the federal funds rate set by the Federal Reserve, and the financial health of the bank or credit union.

Are high savings rates always the best?

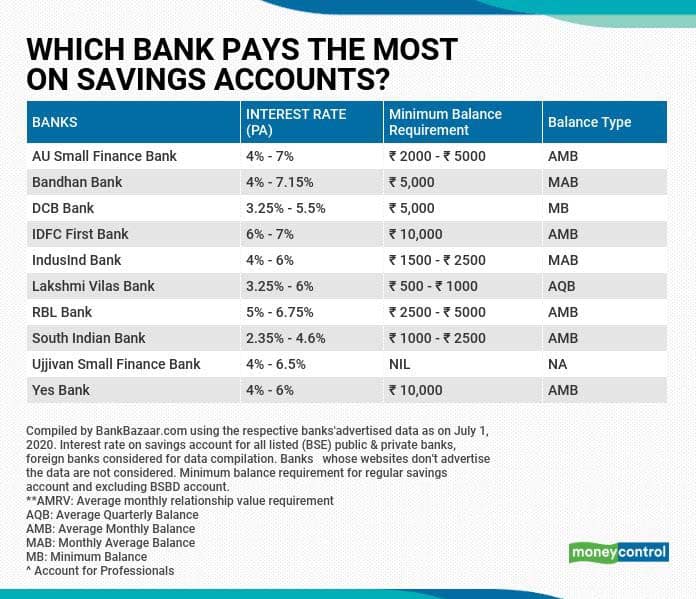

While high savings rates are attractive, consider other factors like fees, minimum balance requirements, and customer service when choosing a savings account. Ensure the overall package meets your needs.

By taking the time to research and compare savings rates, you can make the most of your savings and achieve your financial goals sooner. Start exploring your options today and unlock your financial potential!