Read more about crypto bull run here.

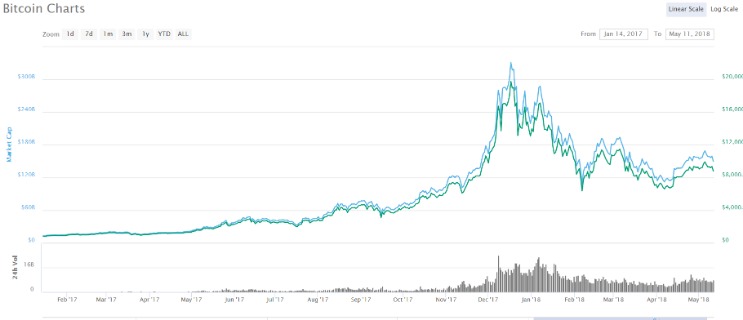

With the recent surge in cryptocurrency prices, many are speculating that a crypto bull run is on the horizon. For those unfamiliar with the term, a bull run is a period of sustained increase in asset prices, typically characterized by optimism and investor confidence.

What Causes a Crypto Bull Run?

There are several factors that can contribute to a crypto bull run, including increasing adoption and mainstream acceptance of cryptocurrencies, positive regulatory developments, and overall market sentiment. Additionally, institutional investors entering the space can also fuel a bull run as they bring in significant capital and legitimacy to the market.

Investing During a Bull Run

For investors looking to capitalize on a crypto bull run, timing is crucial. It’s essential to conduct thorough research on different cryptocurrencies and projects to identify those with strong fundamentals and growth potential. Diversification is key to managing risk during a bull run, as the crypto market can be highly volatile.

It’s also important to set realistic goals and have a clear exit strategy in place. While a bull run can be an exciting time for investors, it’s important to remember that market cycles are inevitable, and prices can experience significant corrections.

In conclusion, a crypto bull run can present lucrative opportunities for investors, but it’s essential to approach it with caution and diligence. By staying informed and being strategic in your investments, you can potentially benefit from the positive momentum in the crypto market.